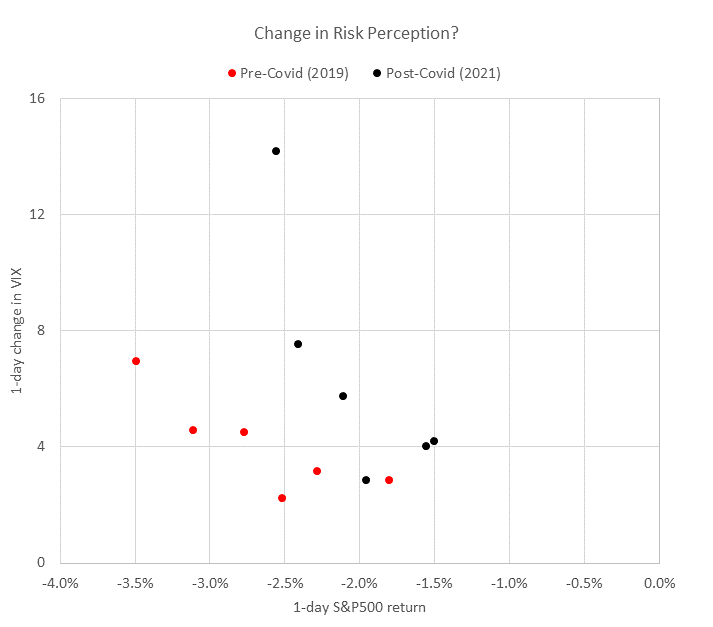

Risk Perception has Changed Post-COVID Market Crash

Markets are well on their way to posting another record year and the Covid crash now looks like a blip, albeit a big one, in the unstoppable rally. But is there more to this than meets the eye? We plotted the worst S&P500 daily returns from January to August 2019 versus the daily changes in the VIX and compared this to the data from the same period in 2021. An elevated nervousness in the post-Covid era is clearly observable – the jumps in the VIX are higher on the days when the S&P500 is down. Some of the likely reasons for this change in the risk perception are not only related to the lingering memory of the Covid crash, but also due to the increasing concerns related to the withdrawal of the supply of liquidity and increasingly stretched equity valuations.

Change in risk perception?